Time. Patience. Discipline. Diligence.

These are the four key components investors need to do a proper job of managing their portfolio. If you are someone who believes you can build a retirement nest egg by dabbing in the markets, it is unlikely you will ever have enough to stop working.

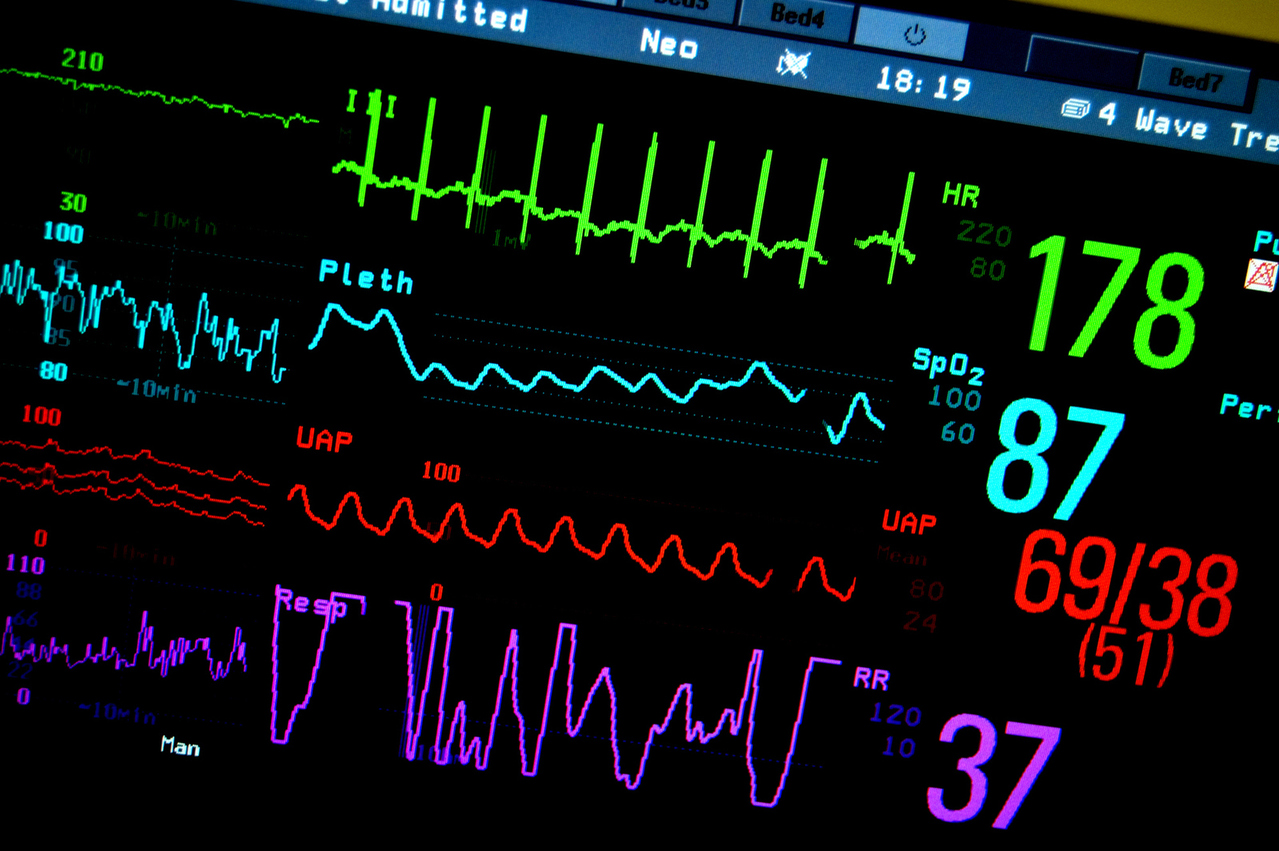

One of the most overlooked aspects of investing is aggressive monitoring of your investments. Now, we are not talking about “day trader” stuff where you spend all day hitting the refresh button on your browser for updates. But it is imperative that you monitor not just what is going on in your own portfolio, but what is happening in other investments options that may fit within your strategy.

Investing is not set-it-and-forget-it and your portfolio won’t stand a chance if you treat it that way.

Sure, you can make money in a bull market, but how well protected is your portfolio from the next downturn. After all, it’s a matter of when, not if, it will come. That protection requires skill, discipline and constant attention. Your financial strength is critical to your ability to live at a high standard of living now and in retirement. Complacency is a dangerous place to live.

If you are not paying attention, you just might miss an opportunity to avoid losses or realize gains. As quickly as things change today – 2020 pandemic anyone – you have to be ready to move.

Find a Pro

Optimizing your portfolio requires a level of attention that most individuals do not have time for. Between work and family who has time to go through all the prospectuses, read the economic outlooks, listen to investor calls. You know, all the things that financial planners to as part of their jobs.

You have financial goals for the future. Maybe it’s college for your kids or paying for a wedding or a down payment on a house. Whatever they are, professional financial planners are trained to help investors identify their long-term goals and work with them to achieve those goals.

No one can predict returns or market movements, but financial planners have the knowledge and experience to develop investment strategies that mitigate risks and put you in the best possible position to optimize your portfolio so you can pay for your daughter’s dream wedding.

You put your car in the hands of a mechanic and your physical health in the hands of a doctor for a reason. They are highly trained professionals who are dedicated to helping you, or your car, be healthy and active for as long as possible. Why wouldn’t you do the same with your money, unless you think you have the time, patience, discipline and diligence to do it.

Putting your long-term investing in the hands of a professional financial planner, will put your portfolio on a solid foundation for growth, grounded in the seven principles of long-term investing.